Cryptocurrency regulations are rapidly evolving, shaping the future of digital assets. From anti-money laundering (AML) measures to taxation frameworks, governments worldwide are grappling with the challenges and opportunities presented by cryptocurrencies. This article delves into the complexities of cryptocurrency regulations, exploring their impact on exchanges, wallets, and the industry as a whole.

Definition and Scope of Cryptocurrency Regulations

Cryptocurrency regulations refer to the set of laws and guidelines established by governments and regulatory bodies to oversee the cryptocurrency industry. These regulations aim to protect investors, prevent fraud, and ensure the stability of the financial system.

Cryptocurrency regulations vary across jurisdictions, with some countries adopting comprehensive frameworks while others have yet to establish clear guidelines. The types of regulations include:

- Registration and licensing requirements for cryptocurrency exchanges and other service providers

- Anti-money laundering and know-your-customer (KYC) rules to prevent illicit activities

- Taxation guidelines for cryptocurrency transactions

- Consumer protection measures to safeguard investors from scams and market manipulation

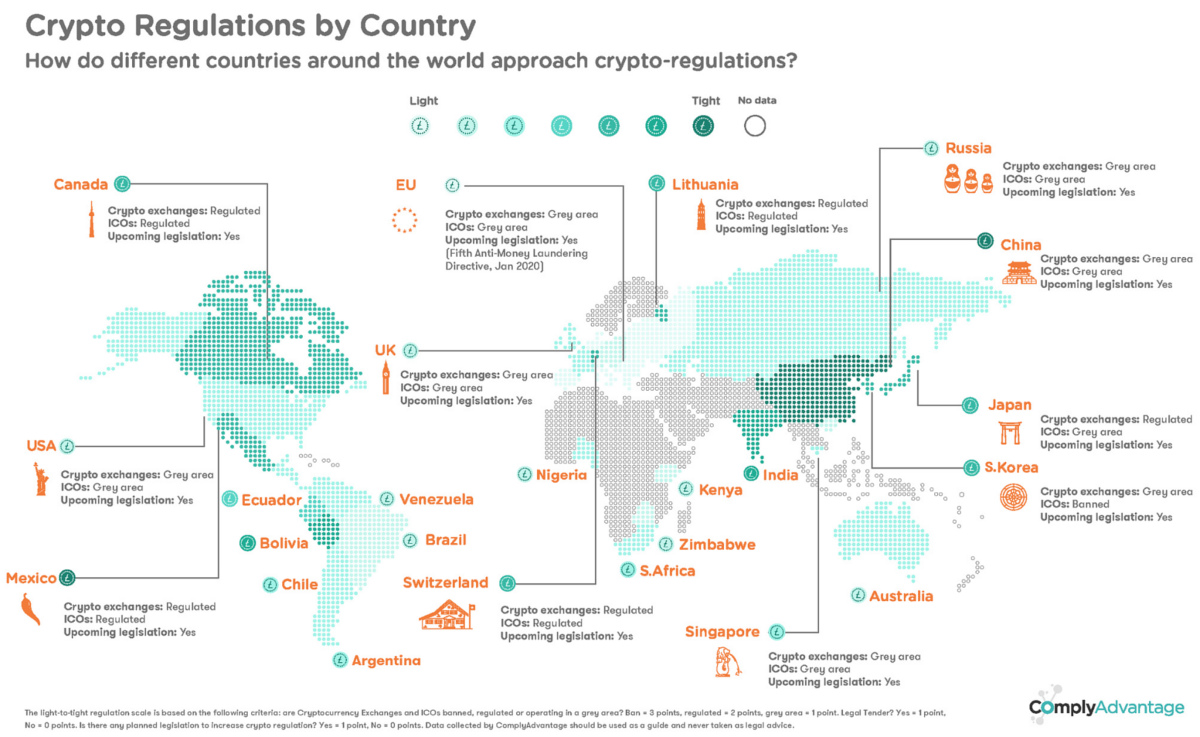

Countries with comprehensive cryptocurrency regulations include the United States, the United Kingdom, Japan, and Singapore. These regulations provide a clear legal framework for the industry and help foster innovation while mitigating risks.

Key Regulatory Considerations

Cryptocurrency regulations have become increasingly important as the industry has grown and matured. Regulators around the world are grappling with how to regulate this new asset class, and there is still much uncertainty about how the regulatory landscape will evolve.

However, there are a number of key regulatory considerations that all cryptocurrency exchanges, wallets, and other service providers should be aware of.One of the most important regulatory considerations is anti-money laundering (AML) and know-your-customer (KYC) regulations. AML regulations are designed to prevent criminals from using cryptocurrency to launder money, while KYC regulations require businesses to collect and verify the identity of their customers.

These regulations are essential for preventing the cryptocurrency industry from being used for illegal activities.Another key regulatory consideration is taxation. The taxation of cryptocurrency is a complex issue, and there is still much uncertainty about how different jurisdictions will tax cryptocurrency transactions.

However, it is important for businesses to be aware of the tax implications of cryptocurrency transactions in their jurisdiction.

AML and KYC Regulations

AML and KYC regulations are designed to prevent criminals from using cryptocurrency to launder money and finance terrorism. These regulations require businesses to collect and verify the identity of their customers, and to report any suspicious transactions to the authorities.There are a number of different AML and KYC regulations that businesses need to be aware of, including the Bank Secrecy Act (BSA) in the United States, the Proceeds of Crime Act (POCA) in the United Kingdom, and the Anti-Money Laundering and Counter-Terrorism Financing Act (AMLCFTA) in Canada.Businesses that fail to comply with AML and KYC regulations may face significant penalties, including fines and imprisonment.

Taxation of Cryptocurrency

The taxation of cryptocurrency is a complex issue, and there is still much uncertainty about how different jurisdictions will tax cryptocurrency transactions. However, it is important for businesses to be aware of the tax implications of cryptocurrency transactions in their jurisdiction.In the United States, the Internal Revenue Service (IRS) has classified cryptocurrency as property, which means that it is subject to capital gains tax when it is sold.

The IRS has also issued guidance on how to calculate the cost basis of cryptocurrency, which is important for determining the amount of capital gains tax that is owed.Other jurisdictions have also issued guidance on the taxation of cryptocurrency. For example, the United Kingdom’s Her Majesty’s Revenue and Customs (HMRC) has classified cryptocurrency as an intangible asset, which means that it is subject to income tax and capital gains tax.Businesses that fail to comply with the tax laws in their jurisdiction may face significant penalties, including fines and imprisonment.

Regulatory Frameworks in Different Jurisdictions: Cryptocurrency Regulations

The regulatory landscape for cryptocurrencies varies widely across different jurisdictions. Some countries have adopted a proactive approach, implementing comprehensive frameworks to govern the industry, while others have taken a more cautious stance, opting for a wait-and-see approach.

The regulatory uncertainty surrounding cryptocurrencies has had a significant impact on the industry. It has created a barrier to entry for some businesses and made it difficult for investors to assess the risks and potential rewards of investing in cryptocurrencies.

Case Studies

There are a number of case studies that illustrate the impact of different regulatory approaches on the cryptocurrency industry.

- China:China has taken a hardline approach to cryptocurrency regulation, banning initial coin offerings (ICOs) and cryptocurrency exchanges. This has led to a significant decline in cryptocurrency activity in China.

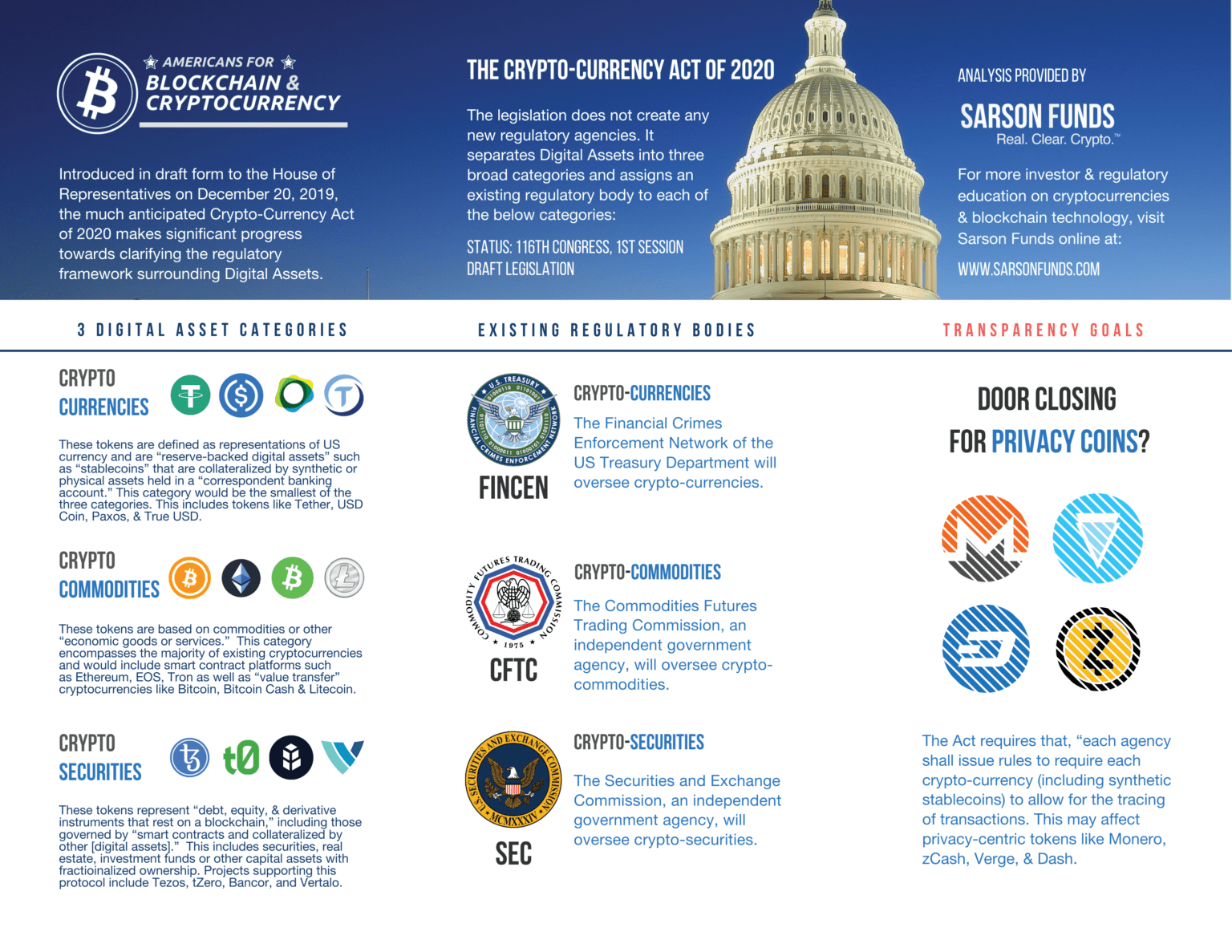

- United States:The United States has taken a more measured approach to cryptocurrency regulation. The Securities and Exchange Commission (SEC) has classified many ICOs as securities offerings, which has brought them under the purview of existing securities laws. This has provided some clarity for investors, but it has also made it more difficult for some businesses to launch ICOs.

- Japan:Japan has been one of the most progressive countries in terms of cryptocurrency regulation. In 2017, the Japanese government passed a law that recognized cryptocurrencies as legal tender. This has helped to create a more stable and predictable regulatory environment for the cryptocurrency industry in Japan.

Challenges and Future Trends

Implementing effective cryptocurrency regulations poses several challenges. One key issue is the decentralized nature of cryptocurrencies, making it difficult for authorities to monitor and enforce regulations. Additionally, the rapid evolution of the cryptocurrency market and the emergence of new technologies, such as decentralized finance (DeFi), further complicate regulatory efforts.

Impact of New Technologies

The rise of DeFi, which involves financial transactions conducted on decentralized platforms without intermediaries, challenges traditional regulatory frameworks. DeFi protocols operate autonomously, making it difficult for regulators to apply existing laws and regulations designed for centralized financial systems.

Future Trends, Cryptocurrency regulations

Looking ahead, several trends are expected to shape the future of cryptocurrency regulations. Firstly, increased collaboration between international regulatory bodies is anticipated to harmonize regulations and prevent regulatory arbitrage. Secondly, the development of new technologies, such as blockchain analytics tools, may enhance regulators’ ability to monitor and enforce regulations.

Finally, the growing adoption of cryptocurrencies by mainstream institutions may lead to increased regulatory scrutiny and the establishment of more comprehensive regulatory frameworks.

Conclusive Thoughts

As the cryptocurrency landscape continues to expand, so too will the need for robust and adaptable regulations. By fostering collaboration between regulators, industry leaders, and the public, we can create a regulatory environment that supports innovation while protecting investors and maintaining financial stability.

Questions and Answers

What are the key regulatory considerations for cryptocurrency exchanges?

Key regulatory considerations include AML compliance, KYC regulations, and taxation frameworks.

How are different jurisdictions approaching cryptocurrency regulations?

Regulatory frameworks vary significantly across jurisdictions, with some countries adopting comprehensive regulations and others taking a more cautious approach.

What are the challenges in implementing effective cryptocurrency regulations?

Challenges include the decentralized nature of cryptocurrencies, the need for international cooperation, and the rapid pace of technological innovation.