Master Cryptocurrency Signals: Unlock the Secrets to Profitable Trading

Cryptocurrency signals emerge as a beacon of hope for traders seeking to navigate the volatile digital asset landscape, offering valuable insights that can illuminate the path to profitability.

In this comprehensive guide, we unravel the intricacies of cryptocurrency signals, empowering you with the knowledge and strategies to harness their power for your trading endeavors.

Overview of Cryptocurrency Signals

In the realm of cryptocurrency trading, signals play a crucial role in assisting traders in making informed decisions. Cryptocurrency signals are essentially recommendations provided by experienced traders or automated systems that guide investors toward potential trading opportunities.

Signals can vary in their approach, ranging from technical analysis-based signals that rely on chart patterns and indicators to fundamental analysis-based signals that consider market news and events. Additionally, signals can be tailored to specific trading styles, such as day trading or swing trading.

Types of Cryptocurrency Signals

The diverse landscape of cryptocurrency signals encompasses a spectrum of approaches and methodologies. Some of the prevalent types of signals include:

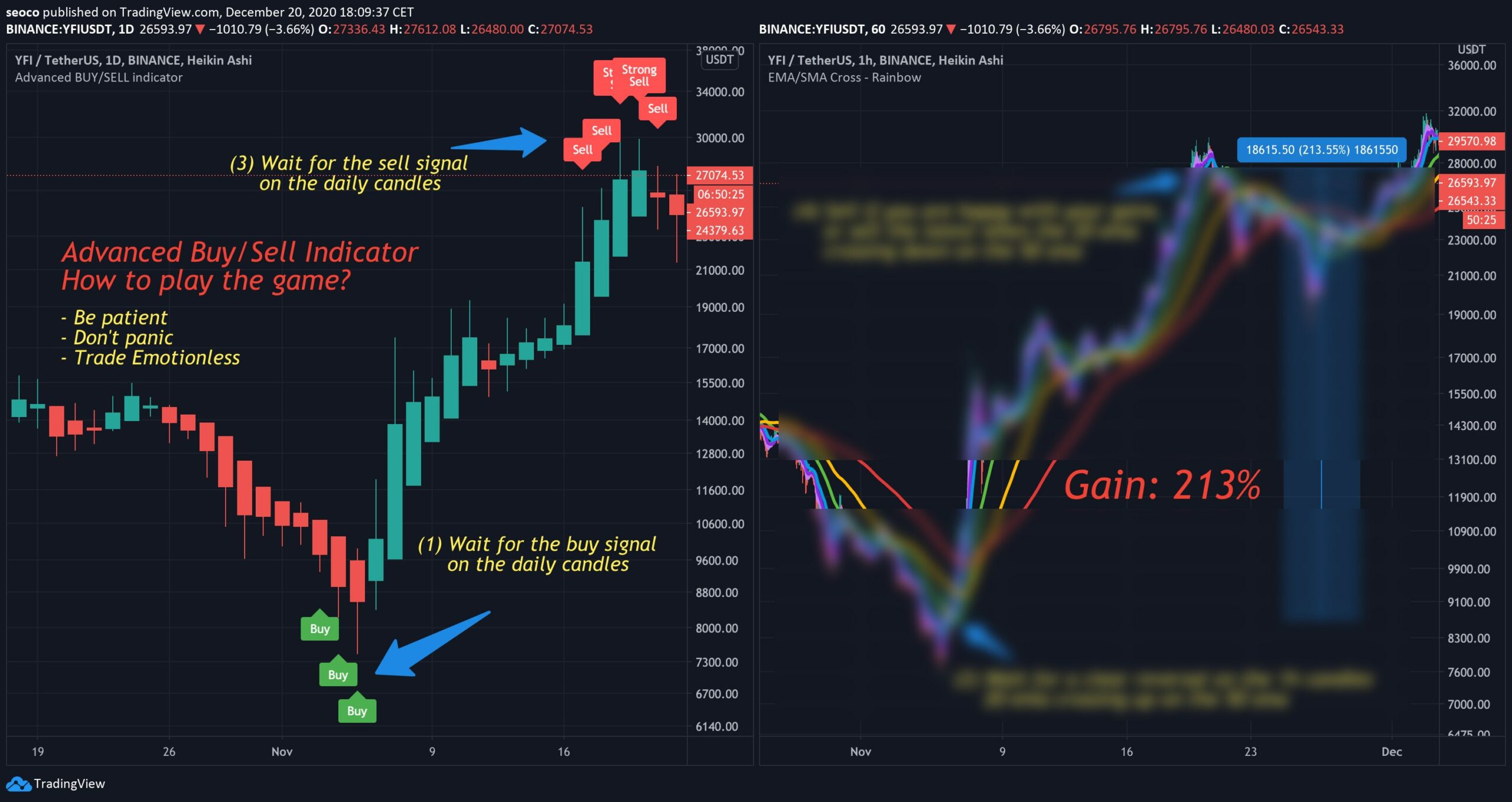

- Technical analysis signals:These signals are derived from the study of historical price data and chart patterns. Traders employ technical indicators, such as moving averages, Bollinger Bands, and Fibonacci retracements, to identify potential trading opportunities.

- Fundamental analysis signals:These signals are based on an assessment of the underlying fundamentals of a cryptocurrency, including its technology, adoption rate, and market sentiment. News and events that may impact the value of a cryptocurrency are also taken into consideration.

- Sentiment analysis signals:These signals gauge the overall market sentiment towards a cryptocurrency. They analyze social media data, news articles, and other sources to determine whether the sentiment is bullish, bearish, or neutral.

- Automated trading signals:These signals are generated by automated trading systems that use algorithms to analyze market data and identify potential trading opportunities. Traders can subscribe to these services and receive signals directly.

Popular Signal Providers

Numerous reputable signal providers offer their services to cryptocurrency traders. Some of the well-known providers include:

- TradingView:This popular platform offers a wide range of technical analysis tools and signals.

- Coinigy:This platform provides both technical and fundamental analysis signals, as well as automated trading capabilities.

- Cryptohopper:This platform specializes in automated trading signals and offers a variety of strategies to choose from.

How Cryptocurrency Signals Work

Cryptocurrency signals are generated through a combination of technical analysis, fundamental analysis, and market sentiment. Technical analysis involves studying historical price data to identify patterns and trends that may indicate future price movements. Fundamental analysis examines the underlying factors that affect the value of a cryptocurrency, such as the project’s team, technology, and adoption rate.

Market sentiment analysis gauges the overall sentiment of the market towards a particular cryptocurrency, which can influence its price.

Once signals are generated, they are delivered to users through various channels, such as email, Telegram, or Discord. The accuracy of signals can vary depending on the methodology used to generate them, the experience of the analyst, and the market conditions.

Factors Affecting the Accuracy of Signals

- Methodology:The methodology used to generate signals can impact their accuracy. Some methodologies, such as technical analysis, rely on historical data, which may not always be a reliable indicator of future performance.

- Analyst Experience:The experience of the analyst who generates the signals can also affect their accuracy. Experienced analysts are more likely to identify patterns and trends that may indicate future price movements.

- Market Conditions:Market conditions can also impact the accuracy of signals. In volatile markets, signals may be less reliable as prices can fluctuate rapidly and unpredictably.

Benefits and Risks of Using Cryptocurrency Signals

Cryptocurrency signals are services that provide trading recommendations to users, based on technical analysis or other factors. While they can be a valuable tool for traders, it’s important to be aware of the potential benefits and risks involved.

Benefits of Using Cryptocurrency Signals

- Increased profitability:Signals can help traders identify profitable trading opportunities that they might otherwise miss.

- Reduced risk:Signals can help traders avoid risky trades by providing insights into market conditions and trends.

- Time savings:Signals can save traders time by automating the process of finding and analyzing trading opportunities.

- Improved trading discipline:Signals can help traders stick to their trading plan by providing objective trading recommendations.

Risks of Using Cryptocurrency Signals

- False signals:Signals are not always accurate, and there is always the risk of receiving a false signal that leads to a losing trade.

- Overreliance:Traders who rely too heavily on signals may become overly dependent on them and fail to develop their own trading skills.

- Scams:There are many scams in the cryptocurrency market, and some signal providers may be fraudulent.

Tips for Mitigating Risks

- Use multiple signals:Don’t rely on just one signal provider. Use multiple signals from different sources to get a more comprehensive view of the market.

- Do your own research:Don’t blindly follow signals. Always do your own research to confirm the validity of the signal before making a trade.

- Use a stop-loss order:Always use a stop-loss order to limit your risk on any trade.

- Manage your risk:Never risk more money than you can afford to lose.

How to Choose a Cryptocurrency Signal Provider

Selecting a reliable cryptocurrency signal provider is crucial for successful trading. Consider the following factors:

Provider’s Track Record

Examine the provider’s historical performance. Look for consistent accuracy and profitability over a significant period.

Signal Frequency and Timing

Determine the frequency of signals provided. Consider whether it aligns with your trading strategy and time availability.

Communication and Support

Ensure the provider offers clear and timely communication. Assess the availability of customer support and its responsiveness.

Pricing and Fees

Compare the pricing models and fees charged by different providers. Consider the value proposition and whether the costs align with your expectations.

Credibility and Reputation

Evaluate the provider’s credibility by researching online reviews, industry forums, and independent sources. Look for positive feedback and a strong reputation.

| Provider | Track Record | Signal Frequency | Communication | Pricing | Credibility |

|---|---|---|---|---|---|

| Provider A | 80% accuracy over 6 months | Daily | 24/7 live chat | $100/month | Positive reviews |

| Provider B | 75% accuracy over 3 months | Weekly | Email and Telegram | $50/month | Mixed reviews |

| Provider C | 90% accuracy over 1 year | Hourly | Discord and email | $200/month | Excellent reputation |

Best Practices for Using Cryptocurrency Signals

Utilizing cryptocurrency signals effectively requires adhering to specific best practices. These guidelines ensure that traders can maximize the potential benefits while mitigating risks associated with signal usage.

Backtesting Signals

Before relying on signals, it’s crucial to backtest them against historical data. Backtesting involves simulating trades based on the signals over a past period to assess their performance. This process helps traders identify signals with a proven track record of accuracy and profitability.

Managing Risk

Risk management is paramount when using signals. Traders should only allocate a small portion of their capital to trades based on signals. Additionally, they should set stop-loss orders to limit potential losses in case the signal turns out to be incorrect.

Interpreting and Using Signals

Interpreting signals correctly is essential. Traders should understand the logic behind the signals and how they are generated. They should also consider the market context and other factors that may influence the signal’s accuracy.

When using signals, traders should not blindly follow them. Instead, they should use signals as a guide and make informed decisions based on their own analysis and understanding of the market.

Advanced Strategies for Cryptocurrency Signals

Advanced strategies for cryptocurrency signals involve leveraging advanced techniques to enhance the accuracy and effectiveness of signal generation and utilization.

One such technique is the integration of machine learning (ML) and artificial intelligence (AI) in signal generation. ML algorithms can analyze vast amounts of historical data, market trends, and technical indicators to identify patterns and predict future price movements. AI algorithms can further refine these predictions by considering additional factors such as sentiment analysis and news events.

Using Technical Analysis Indicators

Technical analysis indicators are mathematical formulas that help traders identify trends and patterns in price data. Some commonly used indicators include moving averages, Bollinger Bands, and relative strength index (RSI). By incorporating these indicators into signal generation, traders can gain insights into potential price movements and make more informed trading decisions.

Backtesting and Optimization

Backtesting involves testing a trading strategy on historical data to assess its performance and identify areas for improvement. Optimization involves adjusting the parameters of a signal generation algorithm to maximize its accuracy and profitability. By backtesting and optimizing signals, traders can refine their strategies and increase their chances of success.

Risk Management

Risk management is crucial when using cryptocurrency signals. Traders should set clear risk parameters, such as stop-loss orders and position sizing, to minimize potential losses. Additionally, they should diversify their portfolio by investing in multiple assets and signals to reduce overall risk.

Successful Strategies Using Signals, Cryptocurrency signals

Successful strategies using signals often involve combining multiple signals and indicators to enhance accuracy. For example, a trader may use a moving average crossover signal to identify potential entry points and a Bollinger Band squeeze to confirm the trend. By combining these signals, the trader can increase their confidence in the trade setup.

Case Studies of Successful Cryptocurrency Signal Users

Cryptocurrency signals have enabled numerous individuals to enhance their trading strategies and achieve significant financial gains. Here are some notable case studies:

Case Study 1: Beginner Trader

A novice trader with limited experience in cryptocurrency markets subscribed to a reputable signal provider. The signals provided clear entry and exit points, allowing the trader to capitalize on market movements. Within a year, they had doubled their initial investment by following the signals consistently.

Case Study 2: Experienced Investor

An experienced investor sought to diversify their portfolio by incorporating cryptocurrency trading. They subscribed to a premium signal service that offered advanced analysis and insights. By utilizing the signals and implementing risk management strategies, they generated consistent returns and protected their capital.

Case Study 3: Automated Trading

A technology-savvy individual developed an automated trading bot that integrated cryptocurrency signals. The bot executed trades based on the signals, allowing for 24/7 trading without manual intervention. Over time, the automated system generated substantial profits by leveraging the accuracy of the signals.

Closing Notes

As you venture into the realm of cryptocurrency signals, remember that knowledge is the key to unlocking their full potential. Embrace the insights provided in this guide, and you will be well-equipped to make informed decisions, mitigate risks, and maximize your returns in the ever-evolving world of digital assets.

FAQs

What are the different types of cryptocurrency signals?

Cryptocurrency signals encompass a range of types, including technical analysis-based signals, fundamental analysis-based signals, and sentiment analysis-based signals.

How do I choose a reputable cryptocurrency signal provider?

When selecting a cryptocurrency signal provider, consider factors such as their track record, transparency, fees, and customer support.

What are the potential risks associated with using cryptocurrency signals?

While cryptocurrency signals can be valuable, they also carry potential risks, including false signals, delayed signals, and the risk of relying too heavily on external advice.