Your Comprehensive Cryptocurrency Guide: Unlocking the Digital Asset Revolution

Cryptocurrency guide embarks on an enlightening journey into the realm of digital currencies, empowering you with a comprehensive understanding of their origins, types, benefits, and the transformative technology that underpins them.

As we delve into the intricacies of cryptocurrency, we’ll uncover the market dynamics, security measures, investment strategies, and regulatory landscape that shape this rapidly evolving ecosystem.

Introduction to Cryptocurrency

Cryptocurrency, a digital or virtual currency, has gained significant attention in recent years. Its origins can be traced back to the late 1990s, with the emergence of concepts like digital cash and e-gold. However, it was the launch of Bitcoin in 2009 that marked a turning point in the evolution of cryptocurrencies.

Cryptocurrencies are decentralized, meaning they are not subject to the control of any central authority, such as a government or bank. Instead, they rely on a distributed ledger technology called blockchain, which records transactions in a secure and transparent manner.

This decentralized nature offers several advantages, including enhanced security, increased transparency, and the potential for lower transaction costs.

Types of Cryptocurrencies

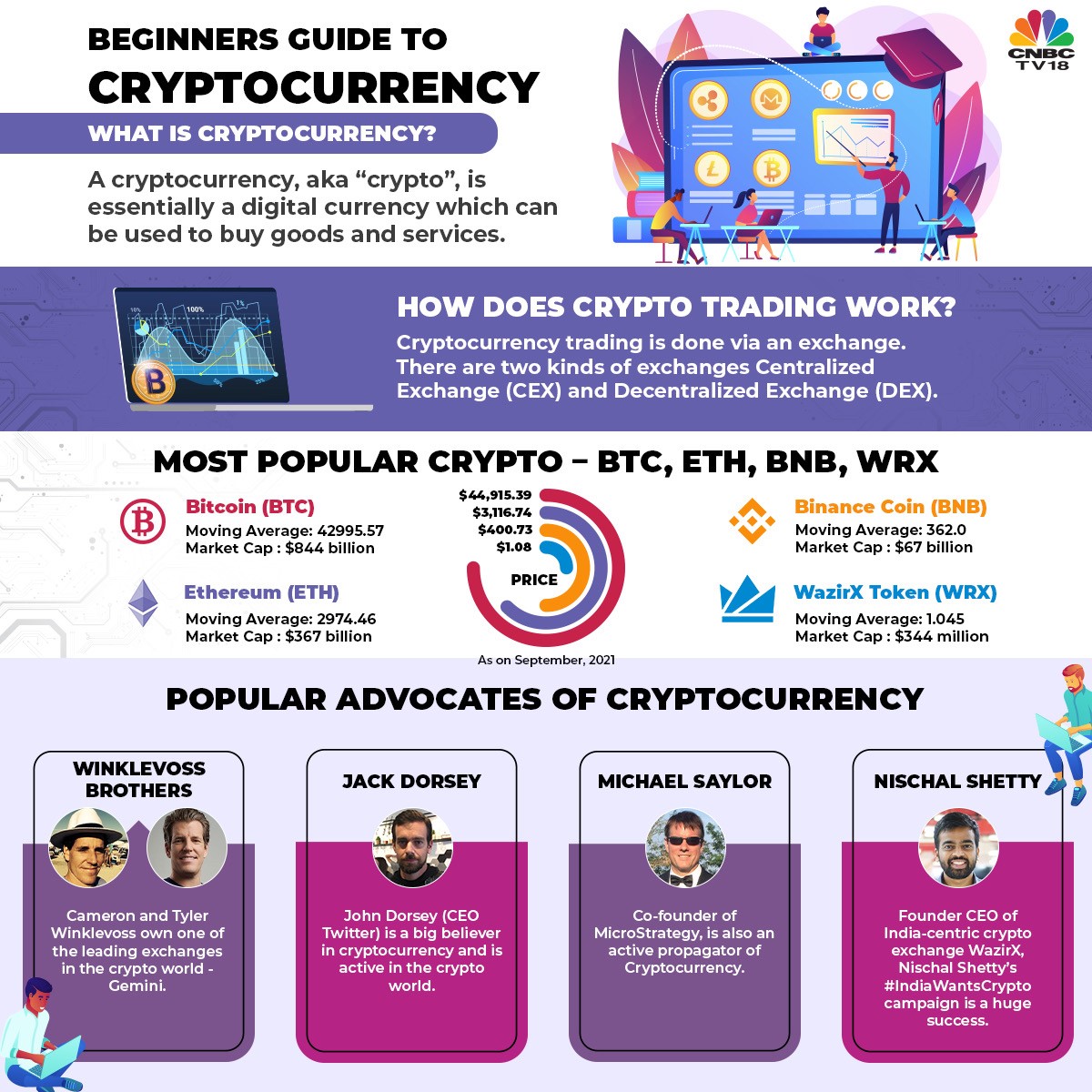

There are numerous types of cryptocurrencies available today, each with its own unique characteristics and use cases. Some of the most popular cryptocurrencies include:

- Bitcoin (BTC):The original and most well-known cryptocurrency, known for its high market capitalization and decentralized nature.

- Ethereum (ETH):A blockchain platform that supports smart contracts and decentralized applications, making it a popular choice for developers.

- Binance Coin (BNB):The native token of the Binance cryptocurrency exchange, used for paying trading fees and accessing additional features.

- Tether (USDT):A stablecoin pegged to the value of the US dollar, designed to provide stability and reduce volatility in the cryptocurrency market.

- Dogecoin (DOGE):A meme-inspired cryptocurrency that gained popularity due to its association with Elon Musk and its use in online tipping.

Cryptocurrency Market Analysis

The cryptocurrency market is a dynamic and ever-evolving landscape, characterized by rapid price fluctuations and significant market volatility. Understanding the current state of the market is crucial for investors and traders alike, as it provides insights into potential opportunities and risks.

As of [Date], the total market capitalization of all cryptocurrencies stands at approximately [Value], with a daily trading volume of [Value]. Bitcoin, the largest cryptocurrency by market cap, currently accounts for [Percentage]% of the total market share, followed by Ethereum at [Percentage]%.

The market has witnessed a significant surge in the past year, with the total market cap increasing by [Percentage]% since [Date].

Market Trends and Patterns

The cryptocurrency market has exhibited several notable trends and patterns over time. One prominent trend is the cyclical nature of market movements, with periods of rapid growth followed by corrections and consolidations. This pattern is influenced by a combination of factors, including market sentiment, technological advancements, and regulatory developments.

- Bull Market:Characterized by sustained price increases and high levels of investor optimism.

- Bear Market:Characterized by prolonged price declines and low levels of investor confidence.

- Altcoin Season:A period where altcoins (cryptocurrencies other than Bitcoin) experience significant price increases relative to Bitcoin.

Another notable pattern is the emergence of decentralized finance (DeFi) and non-fungible tokens (NFTs). DeFi protocols enable users to access financial services such as lending, borrowing, and trading without the need for intermediaries. NFTs, on the other hand, represent unique digital assets that are stored on a blockchain and can be used to represent ownership of items such as art, music, and collectibles.

Cryptocurrency Technology

Cryptocurrencies are built upon a foundation of advanced technologies, primarily blockchain and cryptography. These technologies enable the secure and decentralized operation of cryptocurrencies, ensuring their unique characteristics and potential.

At the core of cryptocurrency technology lies blockchain, a distributed ledger system that records and verifies transactions across a network of computers. Each block in the blockchain contains a cryptographic hash of the previous block, creating an immutable and tamper-proof chain of records.

This decentralized architecture eliminates the need for intermediaries and ensures the integrity and transparency of transactions.

Cryptography

Cryptography plays a crucial role in securing cryptocurrencies. It involves the use of mathematical algorithms to encrypt and decrypt data, ensuring the confidentiality and authenticity of transactions. Cryptographic techniques, such as public-key cryptography and digital signatures, allow users to securely send and receive cryptocurrencies without revealing their identities.

Consensus Mechanisms

Consensus mechanisms are essential for maintaining the integrity and consistency of blockchain networks. These mechanisms ensure that all nodes in the network agree on the validity of transactions and the state of the blockchain. Common consensus mechanisms include Proof of Work (PoW), Proof of Stake (PoS), and Delegated Proof of Stake (DPoS).

- Proof of Work (PoW):Requires miners to solve complex mathematical puzzles to validate transactions. This process is computationally intensive and energy-consuming.

- Proof of Stake (PoS):Selects validators based on the amount of cryptocurrency they hold. Validators are responsible for verifying transactions and adding new blocks to the blockchain.

- Delegated Proof of Stake (DPoS):Similar to PoS, but allows users to delegate their voting power to representatives who validate transactions on their behalf.

Real-World Applications

Cryptocurrency technology has a wide range of real-world applications beyond financial transactions:

- Supply Chain Management:Tracking the movement of goods and materials throughout the supply chain, ensuring transparency and efficiency.

- Digital Identity:Creating secure and verifiable digital identities for individuals, reducing fraud and identity theft.

- Voting Systems:Enabling secure and transparent voting processes, reducing the risk of manipulation or fraud.

- Healthcare:Storing and managing patient data securely, improving patient privacy and data accessibility.

Cryptocurrency Security

Cryptocurrencies are secured using various measures, including cryptography, blockchain technology, and decentralized networks. Cryptography employs encryption algorithms to protect data and transactions, while blockchain technology creates a secure and transparent record of all transactions. Decentralized networks distribute control and validation across multiple nodes, making it difficult for any single entity to compromise the system.

Risks and Vulnerabilities

Despite these security measures, cryptocurrencies are not immune to risks and vulnerabilities. These include:

- Hacking and Theft:Cryptocurrency exchanges and wallets can be hacked, leading to the theft of funds.

- Phishing Scams:Fraudsters use phishing emails or websites to trick users into revealing their private keys or other sensitive information.

- Malware:Malicious software can infect devices and steal cryptocurrency funds.

- Rug Pulls:Developers abandon a project and take investors’ funds.

- Price Volatility:The value of cryptocurrencies can fluctuate rapidly, leading to potential losses.

Tips for Keeping Cryptocurrencies Safe, Cryptocurrency guide

To keep cryptocurrencies safe, follow these tips:

- Use Strong Passwords:Create strong and unique passwords for your cryptocurrency accounts.

- Enable Two-Factor Authentication (2FA):Add an extra layer of security by enabling 2FA on your accounts.

- Store Cryptocurrencies in Hardware Wallets:Hardware wallets provide offline storage for your cryptocurrencies, making them less vulnerable to hacking.

- Be Cautious of Phishing Scams:Never share your private keys or other sensitive information with anyone.

- Educate Yourself:Stay informed about cryptocurrency security risks and best practices.

Cryptocurrency Investment

Cryptocurrency investment involves purchasing digital assets with the expectation of future price appreciation or utility gains. There are several ways to invest in cryptocurrencies, each with its own risks and rewards.

One common method is buying cryptocurrencies directly from exchanges or brokers. Exchanges like Coinbase, Binance, and Kraken allow users to purchase cryptocurrencies using fiat currencies (e.g., USD, EUR) or other cryptocurrencies.

Another option is investing in cryptocurrency funds or trusts. These investment vehicles provide exposure to a diversified portfolio of cryptocurrencies, reducing risk compared to investing in a single asset.

Investors can also invest in cryptocurrency-related companies, such as miners, hardware manufacturers, and software developers. This indirect investment approach allows investors to participate in the growth of the cryptocurrency industry without directly owning digital assets.

Risks and Rewards

Investing in cryptocurrencies carries both risks and rewards. The high volatility of cryptocurrencies means that prices can fluctuate significantly, leading to potential losses or gains.

Other risks include regulatory uncertainty, security breaches, and the potential for scams. However, cryptocurrencies also offer potential rewards, such as high growth potential, inflation hedging, and access to decentralized financial services.

Investment Strategies

To manage the risks and maximize the rewards of cryptocurrency investment, investors should consider employing various strategies.

Diversification is crucial, as it reduces the risk of losing all investments due to the volatility of a single cryptocurrency.

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the cryptocurrency’s price. This strategy helps to reduce the impact of price fluctuations.

Hodling, or holding cryptocurrencies for an extended period, is a strategy that aims to capture long-term price appreciation.

Cryptocurrency Regulations

The regulatory landscape for cryptocurrencies is constantly evolving as governments and financial institutions grapple with the challenges and opportunities presented by this new asset class.

Currently, the regulatory framework for cryptocurrencies varies widely from country to country. Some countries, such as the United States and the United Kingdom, have adopted a relatively hands-off approach, while others, such as China and South Korea, have implemented strict regulations or even banned cryptocurrencies altogether.

Challenges and Opportunities

The lack of a clear and consistent regulatory framework for cryptocurrencies poses a number of challenges for businesses and investors. These challenges include:

- Uncertainty about the legal status of cryptocurrencies

- Difficulty in obtaining banking and other financial services

- Risk of fraud and market manipulation

However, the evolving regulatory landscape also presents a number of opportunities for businesses and investors. These opportunities include:

- The potential for cryptocurrencies to be used as a new form of payment

- The development of new financial products and services based on cryptocurrencies

- The potential for cryptocurrencies to be used as a hedge against inflation and other economic risks

Latest Regulatory Developments

In recent months, there have been a number of significant developments in the regulatory landscape for cryptocurrencies. These developments include:

- The Securities and Exchange Commission (SEC) has taken a more active role in regulating cryptocurrencies, bringing enforcement actions against a number of companies for allegedly selling unregistered securities.

- The Financial Action Task Force (FATF) has issued new guidelines for regulating cryptocurrencies, which are expected to be adopted by many countries.

- The European Union is considering a number of new regulations for cryptocurrencies, including a requirement that all cryptocurrency exchanges be licensed.

These developments suggest that the regulatory landscape for cryptocurrencies is likely to continue to evolve in the coming months and years. Businesses and investors should stay up-to-date on the latest regulatory developments to ensure that they are compliant with the law.

Cryptocurrency Future

The future of cryptocurrencies is highly uncertain, but there are several potential paths that they could take. One possibility is that cryptocurrencies will become more widely adopted as a form of payment. This could happen if businesses begin to accept cryptocurrencies more frequently, or if governments create regulations that make it easier to use cryptocurrencies for everyday transactions.

Another possibility is that cryptocurrencies will become more popular as an investment. This could happen if the price of cryptocurrencies continues to rise, or if more people begin to see cryptocurrencies as a viable alternative to traditional investments such as stocks and bonds.

Challenges Facing Cryptocurrencies

There are also several challenges that cryptocurrencies face in the years to come. One challenge is that cryptocurrencies are still very volatile, and their prices can fluctuate wildly. This makes them a risky investment, and it could deter people from using them as a form of payment.

Another challenge is that cryptocurrencies are not yet widely accepted. This means that it can be difficult to use cryptocurrencies to purchase goods and services, and it could limit their growth as a form of payment.

Opportunities for Cryptocurrencies

Despite the challenges, there are also several opportunities for cryptocurrencies in the years to come. One opportunity is that cryptocurrencies could become more widely adopted as a form of payment. This could happen if businesses begin to accept cryptocurrencies more frequently, or if governments create regulations that make it easier to use cryptocurrencies for everyday transactions.

Another opportunity is that cryptocurrencies could become more popular as an investment. This could happen if the price of cryptocurrencies continues to rise, or if more people begin to see cryptocurrencies as a viable alternative to traditional investments such as stocks and bonds.

Ending Remarks: Cryptocurrency Guide

Cryptocurrency guide concludes with a thought-provoking exploration of the future of digital assets, examining emerging trends, challenges, and opportunities that will define the next chapter in the cryptocurrency revolution.

Whether you’re a seasoned investor, a curious enthusiast, or simply seeking to stay informed about the latest technological advancements, this guide will equip you with the knowledge and insights you need to navigate the exciting world of cryptocurrencies.

Common Queries

What is the underlying technology behind cryptocurrencies?

Cryptocurrencies are built on blockchain technology, a distributed and secure digital ledger that records transactions and prevents unauthorized modifications.

How can I invest in cryptocurrencies?

You can invest in cryptocurrencies through cryptocurrency exchanges, which allow you to buy, sell, and trade digital assets.

What are the risks associated with cryptocurrency investments?

Cryptocurrency investments carry risks such as price volatility, hacking, and regulatory uncertainty.