Mastering Cryptocurrency Analysis: A Comprehensive Guide to Market Dynamics, Technology, and Investment Strategies

Cryptocurrency analysis unlocks a world of financial possibilities, empowering investors with the knowledge to navigate the ever-evolving digital asset landscape. This comprehensive guide delves into the intricacies of cryptocurrency markets, technical and fundamental analysis, blockchain technology, regulatory frameworks, use cases, and investment strategies, providing a roadmap to informed decision-making in the crypto realm.

Market Analysis

The cryptocurrency market is a rapidly evolving and complex ecosystem that has captured the attention of investors, businesses, and governments worldwide. This market is characterized by its decentralized nature, digital asset trading, and the use of cryptography for security and transaction verification.

The cryptocurrency market has experienced significant growth in recent years, driven by factors such as the increasing adoption of digital assets, the emergence of new use cases, and the growing acceptance of cryptocurrencies as a legitimate investment class. However, the market remains highly volatile and subject to significant price fluctuations, which can pose risks to investors.

Key Market Trends

- Increasing Institutional Adoption:Institutional investors, such as hedge funds, venture capital firms, and asset managers, are increasingly allocating capital to cryptocurrencies. This trend is expected to continue as cryptocurrencies become more established and regulated.

- Emergence of Decentralized Finance (DeFi):DeFi refers to a growing ecosystem of financial applications and services built on blockchain technology. DeFi applications allow users to lend, borrow, trade, and manage their crypto assets without the need for traditional financial intermediaries.

- Adoption of Non-Fungible Tokens (NFTs):NFTs are unique digital assets that represent ownership of a specific item, such as a piece of art, music, or video. NFTs have gained significant popularity and are increasingly being used in various industries, including art, gaming, and collectibles.

Key Market Drivers

- Technological Advancements:Ongoing advancements in blockchain technology, such as increased scalability, security, and interoperability, are driving the growth of the cryptocurrency market.

- Regulatory Developments:Governments worldwide are increasingly developing regulations for cryptocurrencies, which is providing greater clarity and legitimacy to the market.

- Increasing Awareness and Acceptance:Cryptocurrencies are becoming more widely known and accepted as a legitimate form of payment and investment. This increased awareness is driving demand for crypto assets.

Key Market Challenges, Cryptocurrency analysis

- Volatility:The cryptocurrency market is known for its high volatility, which can pose risks to investors and hinder mainstream adoption.

- Cybersecurity Threats:Cryptocurrency exchanges and wallets are vulnerable to cyberattacks, which can result in the theft of digital assets.

- Regulatory Uncertainty:The regulatory landscape for cryptocurrencies is still evolving, and there is uncertainty regarding the classification and treatment of crypto assets in different jurisdictions.

Performance of Major Cryptocurrencies

- Bitcoin (BTC):Bitcoin is the largest and most well-known cryptocurrency. It has a strong brand recognition and is widely accepted as a store of value and a medium of exchange.

- Ethereum (ETH):Ethereum is a decentralized blockchain platform that enables the development of smart contracts and decentralized applications. It is the second-largest cryptocurrency by market capitalization.

- Litecoin (LTC):Litecoin is a peer-to-peer cryptocurrency that is often referred to as the “silver to Bitcoin’s gold.” It is known for its fast transaction times and low transaction fees.

Technical Analysis

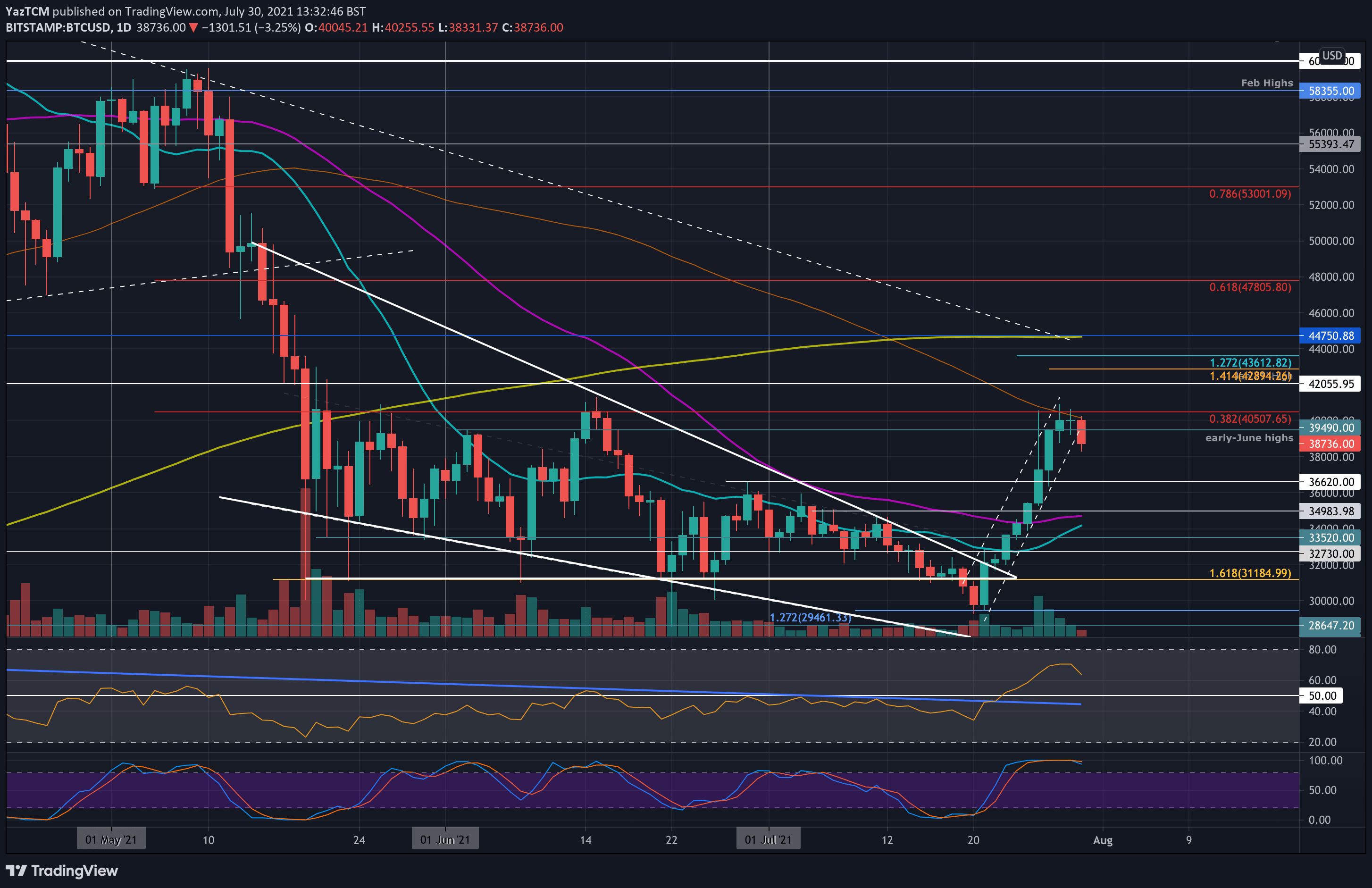

Technical analysis is a method of evaluating the price action of a cryptocurrency to forecast its future price movements. It is based on the assumption that past price movements can be used to predict future price movements.

Technical analysts use a variety of indicators and patterns to identify trading opportunities. Some of the most common indicators include:

- Moving averages

- Bollinger Bands

- Relative Strength Index (RSI)

- Stochastic oscillator

Technical analysts also use chart patterns to identify trading opportunities. Some of the most common chart patterns include:

- Head and shoulders

- Double top

- Double bottom

- Triangle

Technical analysis can be a valuable tool for cryptocurrency traders. However, it is important to remember that it is not a perfect science. There are no guarantees that technical analysis will be able to predict the future price movements of a cryptocurrency.

Use Cases and Adoption: Cryptocurrency Analysis

Cryptocurrencies have emerged as a novel form of digital assets with diverse use cases and growing adoption rates. Businesses and consumers alike are exploring the potential of cryptocurrencies to revolutionize various sectors and enhance financial transactions.

Use Cases

- Digital Payments:Cryptocurrencies facilitate seamless and secure digital payments, eliminating intermediaries and reducing transaction fees.

- Store of Value:Cryptocurrencies like Bitcoin and Ethereum are gaining popularity as a store of value due to their limited supply and potential for long-term appreciation.

- Decentralized Finance (DeFi):Cryptocurrencies empower the creation of decentralized financial applications, such as lending, borrowing, and asset management, without the need for traditional financial institutions.

- Supply Chain Management:Cryptocurrencies offer transparency and efficiency in supply chain management by tracking goods and verifying authenticity.

- Gaming and Entertainment:Cryptocurrencies are increasingly used in gaming and entertainment industries to create virtual economies and reward users.

Adoption

The adoption of cryptocurrencies is growing rapidly, with businesses and consumers embracing their benefits. Major companies like Tesla, PayPal, and Microsoft now accept cryptocurrencies as payment.

- Consumer Adoption:Cryptocurrencies are gaining popularity among consumers as a convenient and secure way to make purchases, invest, and store wealth.

- Business Adoption:Businesses are recognizing the potential of cryptocurrencies to reduce costs, improve efficiency, and reach new markets.

li> Government Adoption:Some governments are exploring the potential of cryptocurrencies as legal tender or as a means to enhance financial inclusion.

Future Trends

The future of cryptocurrency use cases and adoption is promising, with potential applications in various sectors.

- Central Bank Digital Currencies (CBDCs):Central banks are exploring the issuance of CBDCs to enhance financial stability and promote innovation.

- Non-Fungible Tokens (NFTs):NFTs are unique digital assets that represent ownership of digital or physical items, creating new opportunities in art, collectibles, and gaming.

- Metaverse and Web3:Cryptocurrencies are expected to play a significant role in the development of the metaverse and Web3, empowering users with greater control over their digital assets and experiences.

Investment Strategies

Investing in cryptocurrencies involves a range of strategies, each with its own risks and rewards. Understanding these strategies and aligning them with your risk tolerance and investment goals is crucial for successful cryptocurrency investing.

Risk Management

Effective risk management is paramount in cryptocurrency investing. Consider the following measures:

- Diversification:Spread your investments across multiple cryptocurrencies to mitigate risks associated with individual assets.

- Dollar-Cost Averaging:Invest a fixed amount of money at regular intervals, regardless of price fluctuations, to reduce the impact of market volatility.

- Stop-Loss Orders:Set pre-determined price levels at which your assets are automatically sold to limit potential losses.

Investment Styles

Choose an investment style that aligns with your risk tolerance and goals:

- Long-Term Holding:Holding cryptocurrencies for an extended period, aiming for potential appreciation in value over time.

- Trading:Actively buying and selling cryptocurrencies to capitalize on short-term price fluctuations.

- Staking:Holding certain cryptocurrencies in a wallet to earn rewards for supporting the network’s operations.

Consider Your Goals

Define your investment goals before allocating funds:

- Short-Term Profit:Aiming for quick gains through trading or investing in highly volatile cryptocurrencies.

- Long-Term Growth:Seeking sustained value appreciation by investing in established or promising cryptocurrencies.

- Passive Income:Generating regular income through staking or lending cryptocurrencies.

Risks and Rewards

Investing in cryptocurrencies carries both potential rewards and risks:

- High Returns:Cryptocurrencies have the potential to generate substantial returns, especially during bull markets.

- Volatility:Cryptocurrencies are highly volatile, with prices fluctuating rapidly, leading to potential losses.

- Regulatory Uncertainty:The regulatory landscape for cryptocurrencies is evolving, which can impact their value and accessibility.

By understanding the different investment strategies, managing risks, and aligning your investments with your goals, you can increase your chances of success in the dynamic world of cryptocurrency investing.

Summary

As the cryptocurrency industry continues to evolve at a rapid pace, staying abreast of the latest developments and analytical techniques is crucial for investors seeking success in this dynamic market. By mastering the art of cryptocurrency analysis, individuals can unlock the potential for substantial returns while mitigating risks and making informed investment decisions.

FAQ Section

What is cryptocurrency analysis?

Cryptocurrency analysis involves examining various factors to assess the value, potential, and risks associated with cryptocurrencies.

Why is cryptocurrency analysis important?

Cryptocurrency analysis empowers investors with the knowledge to make informed decisions, identify profitable opportunities, and manage risks in the volatile crypto market.

What are the different types of cryptocurrency analysis?

There are three main types of cryptocurrency analysis: market analysis, technical analysis, and fundamental analysis.

How can I get started with cryptocurrency analysis?

Begin by understanding the basics of cryptocurrency markets, technical indicators, and fundamental factors. Practice analyzing charts, researching projects, and monitoring market trends.