Cryptocurrency Updates: Exploring Market Trends, Regulation, Technology, and Investment Strategies

In the rapidly evolving realm of digital finance, Cryptocurrency updates provide a comprehensive overview of the latest market trends, regulatory developments, technological advancements, and investment strategies shaping the cryptocurrency landscape. From the surge of decentralized finance (DeFi) to the rise of non-fungible tokens (NFTs), this article delves into the intricacies of the cryptocurrency ecosystem, empowering readers to make informed decisions in this dynamic and ever-changing market.

As the cryptocurrency market continues to gain traction, understanding its intricacies becomes paramount. This article serves as a valuable resource for investors, enthusiasts, and anyone seeking to stay abreast of the latest developments in the world of digital assets.

Latest Cryptocurrency Market Trends

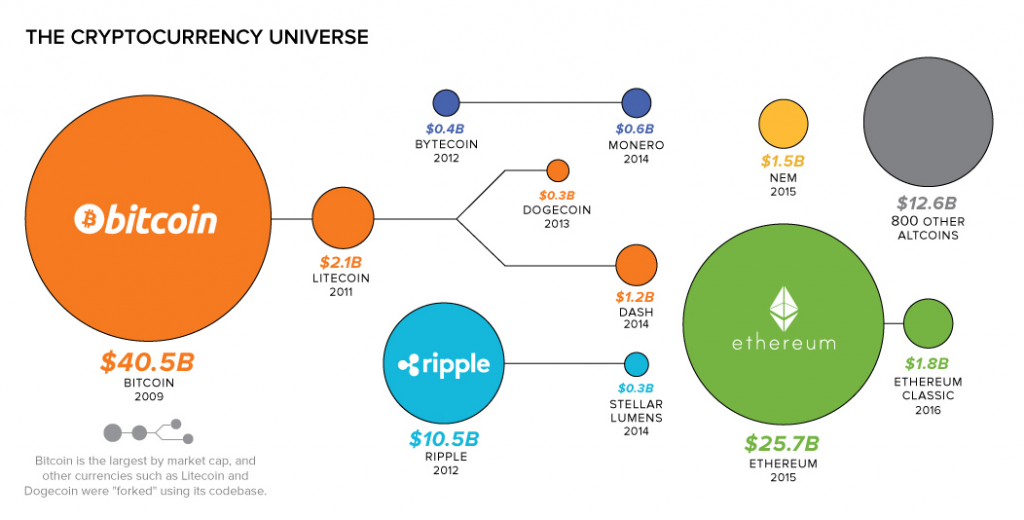

The global cryptocurrency market capitalization currently stands at approximately $1.08 trillion, indicating a significant increase compared to the previous year. Bitcoin (BTC) remains the dominant player, accounting for over 40% of the market share. Ethereum (ETH) and Binance Coin (BNB) follow as the second and third-largest cryptocurrencies by market cap, respectively.Recent price fluctuations in the cryptocurrency market have been influenced by various factors, including macroeconomic conditions, regulatory developments, and technological advancements.

The ongoing geopolitical tensions and global economic uncertainty have contributed to market volatility. Additionally, regulatory scrutiny and enforcement actions by government agencies have impacted market sentiment. Technological innovations, such as the development of decentralized finance (DeFi) applications and non-fungible tokens (NFTs), have also influenced price movements.

Cryptocurrency Regulation and Adoption: Cryptocurrency Updates

The cryptocurrency industry is rapidly evolving, and governments around the world are still trying to figure out how to regulate it. Some countries have embraced cryptocurrencies, while others have taken a more cautious approach.

Regulatory Developments

In the United States, the Securities and Exchange Commission (SEC) has been taking a tough stance on cryptocurrency exchanges, and has brought enforcement actions against several companies. The SEC has also proposed new regulations that would require cryptocurrency exchanges to register with the agency.In the European Union, the European Parliament has passed a new law that will regulate cryptocurrency exchanges and wallet providers.

The law is expected to come into effect in 2023.In China, the government has banned cryptocurrency trading and mining. The ban has had a significant impact on the cryptocurrency market, as China was once one of the largest markets for cryptocurrencies.

Adoption by Countries

Some countries have been more welcoming to cryptocurrencies than others. El Salvador has become the first country in the world to adopt Bitcoin as legal tender. Other countries, such as Japan and Switzerland, have also taken steps to make it easier for businesses to accept cryptocurrencies.However, some countries have taken a more cautious approach to cryptocurrency adoption.

In India, the government has proposed a law that would ban cryptocurrency trading. In Russia, the government has also proposed a law that would restrict the use of cryptocurrencies.

Role of Institutional Investors

Institutional investors, such as hedge funds and pension funds, are playing an increasingly important role in the cryptocurrency market. These investors are attracted to cryptocurrencies because they offer the potential for high returns.The involvement of institutional investors is helping to legitimize the cryptocurrency market and make it more attractive to mainstream investors.

Technological Advancements in Cryptocurrency

The cryptocurrency market is constantly evolving, with new technologies emerging all the time. These innovations are helping to make cryptocurrencies more secure, accessible, and versatile. Here are a few of the most important technological advancements in cryptocurrency:

Blockchain Innovations

The blockchain is the underlying technology that powers cryptocurrencies. It is a distributed, immutable ledger that records all transactions. This makes it very difficult to hack or manipulate, making it a secure way to store and transfer value.

In recent years, there have been a number of advancements in blockchain technology. These advancements have made blockchains more scalable, efficient, and secure. For example, the Lightning Network is a second-layer protocol that allows for faster and cheaper transactions on the Bitcoin blockchain.

Decentralized Finance (DeFi)

DeFi is a new financial system that is built on blockchain technology. DeFi applications allow users to borrow, lend, trade, and save money without the need for a bank or other intermediary.

DeFi is still in its early stages of development, but it has the potential to revolutionize the financial industry. DeFi applications can offer lower fees, faster transactions, and more transparency than traditional financial institutions.

Non-Fungible Tokens (NFTs)

NFTs are a new type of digital asset that is unique and cannot be replicated. This makes them ideal for use in a variety of applications, such as digital art, collectibles, and gaming.

NFTs are still a relatively new technology, but they have the potential to have a major impact on the cryptocurrency market. NFTs could be used to create new markets for digital goods and services, and they could also be used to track and manage ownership of physical assets.

Cryptocurrency Scams and Security

Cryptocurrency scams are a growing problem, as fraudsters take advantage of the anonymity and complexity of digital currencies to steal from unsuspecting victims. Some common cryptocurrency scams include:

- Phishing scams: Fraudsters send fake emails or create fake websites that look like legitimate cryptocurrency exchanges or wallets. They trick victims into entering their login credentials or private keys, which allows them to steal their funds.

- Pump-and-dump scams: Fraudsters artificially inflate the price of a cryptocurrency through false or misleading information. They then sell their own holdings at a profit, leaving other investors with worthless coins.

- Ponzi schemes: Fraudsters promise high returns on investments in cryptocurrency, but the returns are actually paid out of new investors’ money. When the scheme collapses, investors lose their money.

To avoid these scams, it is important to be aware of the risks and to take steps to protect yourself. Here are some tips:

- Only invest in cryptocurrency from reputable sources.

- Never share your login credentials or private keys with anyone.

- Be wary of any investment opportunity that promises high returns with little risk.

- Do your own research before investing in any cryptocurrency.

It is also important to store your cryptocurrency securely. There are a number of different ways to do this, including:

- Hardware wallets: These are physical devices that store your cryptocurrency offline, making them less vulnerable to hacking.

- Software wallets: These are digital wallets that store your cryptocurrency on your computer or mobile device.

- Paper wallets: These are simply pieces of paper with your public and private keys written on them.

The best way to store your cryptocurrency will depend on your individual needs and preferences. However, it is important to choose a method that is secure and convenient for you.Exchanges and regulatory bodies also play an important role in protecting users from fraud.

Exchanges can implement security measures to prevent phishing scams and other types of fraud. They can also provide users with information about the risks of investing in cryptocurrency. Regulatory bodies can help to protect users by enforcing laws against fraud and by providing guidance to exchanges.

Cryptocurrency Investment Strategies

Cryptocurrency investment strategies encompass various approaches to managing and growing digital asset portfolios. Each strategy carries unique risks and rewards, and investors must carefully consider their objectives, risk tolerance, and investment horizon before choosing a particular approach.

Buy and Hold

Buy and hold is a passive investment strategy that involves acquiring and holding cryptocurrencies for an extended period, typically years or even decades. The underlying assumption is that the long-term value of cryptocurrencies will appreciate, potentially leading to significant gains over time.

This strategy suits investors with a low risk tolerance and a belief in the long-term potential of cryptocurrencies.

Trading

Trading involves actively buying and selling cryptocurrencies to capitalize on short-term price fluctuations. Traders employ various technical and fundamental analysis techniques to identify potential trading opportunities and aim to generate profits from both upward and downward market movements. Trading requires a high level of skill, knowledge, and risk tolerance, and is generally not suitable for inexperienced investors.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a disciplined investment strategy that involves investing a fixed amount of money in a cryptocurrency at regular intervals, regardless of the current market price. This approach aims to reduce the impact of market volatility and potentially lower the overall cost basis of the investment.

DCA is suitable for investors who want to mitigate risk and gradually accumulate cryptocurrencies over time.

Yield Farming

Yield farming is an advanced investment strategy that involves lending or staking cryptocurrencies to earn interest or rewards. Investors can participate in decentralized finance (DeFi) protocols that offer yield farming opportunities, allowing them to generate passive income from their digital assets.

However, yield farming carries significant risks, including the potential for loss of principal and exposure to smart contract vulnerabilities.

Diversification

Diversification is a risk management strategy that involves investing in a variety of cryptocurrencies to reduce the overall risk of the portfolio. By spreading investments across different cryptocurrencies with varying characteristics, investors can mitigate the impact of price fluctuations in any single asset.

Diversification is essential for reducing portfolio volatility and increasing the chances of long-term success in cryptocurrency investing.

Cryptocurrency Use Cases and Applications

Cryptocurrencies have evolved beyond mere investment vehicles, finding practical applications across various industries. They offer unique advantages such as decentralization, security, and transparency, making them suitable for a wide range of use cases.

Payments

Cryptocurrencies facilitate secure and efficient payments without intermediaries. Businesses can accept crypto payments globally, reducing transaction fees and cross-border barriers. Consumers can make purchases online or in-store, enjoying faster processing times and enhanced privacy.

Supply Chain Management, Cryptocurrency updates

Cryptocurrencies can revolutionize supply chain management by providing real-time tracking and transparency. Using blockchain technology, each step of the supply chain can be recorded immutably, ensuring product authenticity and preventing counterfeiting.

Identity Verification

Cryptocurrencies can be used for secure identity verification. By storing personal data on a blockchain, individuals can control access to their information and prevent identity theft. This technology can streamline KYC (Know Your Customer) processes and reduce fraud.

Voting and Governance

Cryptocurrencies can enhance the integrity of voting systems. Blockchain-based voting platforms can provide transparency, prevent voter fraud, and increase participation. They can also be used for decentralized governance, allowing communities to make decisions collectively.

Healthcare

Cryptocurrencies can improve healthcare efficiency and patient outcomes. They can be used for secure medical record storage, drug traceability, and insurance payments. Blockchain technology can facilitate data sharing among healthcare providers, streamline clinical trials, and empower patients with control over their medical information.

Conclusive Thoughts

The cryptocurrency market presents a unique and dynamic investment landscape, offering both opportunities and challenges. By staying informed about the latest updates and trends, investors can navigate the complexities of this emerging asset class and position themselves for success in the years to come.

As the regulatory environment evolves and technological advancements continue to shape the industry, the future of cryptocurrency holds endless possibilities.

Question Bank

What are the key factors driving the recent price fluctuations in the cryptocurrency market?

The recent price fluctuations in the cryptocurrency market are influenced by a combination of factors, including global economic conditions, regulatory developments, institutional investment, and market sentiment.

How is the regulatory landscape for cryptocurrencies evolving globally?

The regulatory landscape for cryptocurrencies is rapidly evolving, with different countries adopting varying approaches. Some countries have implemented comprehensive regulations, while others are still in the early stages of developing a regulatory framework.

What is the role of decentralized finance (DeFi) in the cryptocurrency ecosystem?

Decentralized finance (DeFi) refers to financial services built on blockchain technology, offering alternatives to traditional financial institutions. DeFi applications enable users to borrow, lend, trade, and earn interest on cryptocurrencies without intermediaries.

What are non-fungible tokens (NFTs) and what are their potential applications?

Non-fungible tokens (NFTs) are unique digital assets that represent ownership of a specific item, such as a piece of art, music, or collectible. NFTs have gained popularity due to their ability to provide proof of ownership and authenticity in the digital realm.

What are some common cryptocurrency scams and how can investors protect themselves?

Common cryptocurrency scams include phishing attacks, Ponzi schemes, and fake exchanges. Investors can protect themselves by being vigilant, researching potential investments, and using reputable exchanges and wallets.